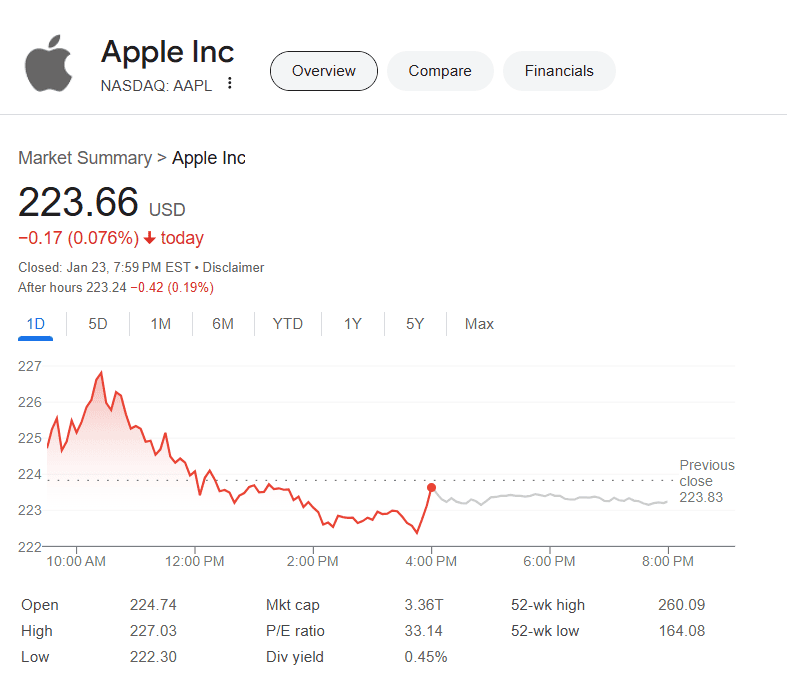

The recent decline in Apple Inc.’s stock has raised concerns about the company’s future, particularly regarding iPhone sales in China. Experts, including Wedbush analyst Daniel Ives, believe these fears are overstated, urging investors to focus on Apple’s potential for innovation and growth.

Factors contributing to the stock drop include increased competition and market saturation. To maintain its competitive edge, Apple needs to continue innovating and diversify its offerings.

Apple’s Stock Performance and Market Challenges

Recent Performance and Contributing Factors

Apple’s stock (AAPL) has seen a decline recently. This drop is due to several factors. One key reason is weaker demand for iPhones, especially in China. Competition from local brands like Vivo and Huawei has increased. These companies offer strong alternatives, impacting Apple’s sales.

Another factor is concern about how well Apple’s new AI features, called “Apple Intelligence,” will boost iPhone sales. Some analysts think these features won’t lead to a big wave of upgrades like some hoped. The smartphone market is also very competitive. Many companies offer good phones at lower prices than Apple. This makes it hard for Apple to grow its market share.

Some experts think Apple’s stock price might be too high. This concern, along with the other issues, has led some financial firms to lower their ratings on Apple stock. This means they think the stock might not perform as well as it did before.

Key Financial Data and Projections

Apple’s financial performance is closely watched by investors. The table below shows some important financial data and projections:

| Metric | Value/Projection | Notes |

|---|---|---|

| iPhone Shipments (2024 projection) | Around 220 million units | Estimates vary, but a slight decline is expected. |

| Apple’s Market Share in China (2024) | Around 15% | Facing strong competition from domestic brands. |

| Average Selling Price (ASP) of iPhones | Around $850 | Varies by model and region. |

| Apple’s Revenue (2024 Estimate) | Around $380 Billion | Influenced by iPhone sales and other product lines. |

The Role of Apple Intelligence and Future Products

Apple is investing in new technologies, especially AI. The company’s “Apple Intelligence” features are meant to make iPhones more useful. However, it is unclear if these features will drive a lot of new sales. Apple is also rumored to be working on new products, like an AR/VR headset. These products could be important for Apple’s future growth.

Headwinds and Competition

Apple faces challenges in the market. The smartphone market is mature, meaning most people who want a smartphone already have one. This makes it harder for companies to sell more phones. Apple also faces stiff competition from other companies. These companies offer similar products at lower prices. This puts pressure on Apple’s sales and profits.

Antitrust Probes

Apple faces antitrust probes in the UK, along with Google. These probes look into whether these companies unfairly control the mobile market. This includes operating systems, app stores, and web browsers. These probes could lead to changes in how Apple does business.

How This Impacts Investors

The recent news about Apple has made some investors worried. The declining iPhone sales and competition are real concerns. However, Apple is a large and innovative company. It has a lot of resources and is working on new products. Investors should carefully watch Apple’s performance and make informed decisions.

Beyond the iPhone: Apple’s Services and Other Products

While the iPhone remains a key product, Apple is expanding its services and other product lines. Apple’s services include Apple Music, iCloud, and the App Store. These services generate recurring revenue, which is important for Apple’s financial stability. Other products, like the Apple Watch and Macs, also contribute to Apple’s revenue. This diversification helps reduce Apple’s reliance on the iPhone. Apple’s AirPods have also become a very popular product and contribute significantly to revenue. This strategy of expanding beyond the iPhone is important for Apple’s long-term growth. It helps Apple reach new customers and create new revenue streams. By focusing on services and other products, Apple aims to become less dependent on the iPhone and build a more stable business.

Disclaimer: This information is for educational purposes only and should not be considered investment advice. Please consult with a qualified financial advisor before making any investment decisions.

Short Summary:

- Wedbush maintains a positive outlook on Apple amidst concerns over declining sales in China.

- The anticipated introduction of AI features could transform Apple’s growth narrative.

- Analysts predict that the upcoming earnings report will shed light on Apple’s performance and future strategy.

As the stock market ushers in 2025, Apple Inc. (AAPL) finds itself in a challenging position, with shares dropping and market sentiment turning cautious. The tech giant’s stock has plummeted more than 8% this year, fueled by fears surrounding its ability to sustain sales growth, particularly in China, a pivotal market for the company. However, Wedbush’s Daniel Ives, a long-time Apple bull, seeks to allay these fears, arguing that the narrative around Apple’s challenges is overblown.

In a research note, Ives remarked,

“We believe the panic and bear frenzy around Apple is way overdone.”

This statement underscores his belief that while the market reacts to potential headwinds, the fundamentals for Apple remain solid. According to Jefferies analysts, who have recently downgraded the company’s rating, the iPhone 17 and 18 models are expected to underperform due to minimal hardware enhancements. They highlighted concerns over the forthcoming iPhone SE 4, positing that demand would be tepid leading up to its expected March release.

On a broader scale, the chip manufacturer Nvidia recently eclipsed Apple to become the world’s most valuable company, a shift that reflects the current market sentiment. Despite these challenges, Ives argues that the decline in sales in China is manageable and will become clearer once Apple announces its collaboration with an AI partner, likely Baidu, Tencent, or ByteDance. This collaboration is critical for the company’s plans to integrate artificial intelligence into its devices, a move Ives believes will invigorate growth.

Wedbush has retained its “Outperform” rating on Apple’s stock, setting a price target of $325. Ives elaborated on this in his note, stating,

“With Apple Intelligence being rolled out in a phased strategy, the iPhone 16 upgrade cycle marks the beginning of a significant growth renaissance at Apple.”

He predicts that nearly 20% of the global population will engage with AI through Apple devices in the upcoming years, marking a major shift in consumer behavior and technological engagement.

The forthcoming quarterly earnings report from Apple, scheduled for January 30th, is set to be a crucial indicator of the company’s trajectory. Analysts are keenly watching for insights on how Apple plans to navigate these turbulent waters, especially given the backdrop of declining iPhone sales in China. Ives optimistically notes that the anxieties surrounding Apple’s market situation in China have often been exaggerated in the past.

“Rome wasn’t built in a day, and neither will Apple’s AI strategy,”

he added, indicating that the groundwork being laid now could pave the way for substantial growth in the future.

Historically, fears regarding Apple’s performance have often led to sharp stock movements but have also created opportunities for investors. The tech conglomerate has weathered numerous storms, from market fluctuations to shifts in consumer preferences, often emerging stronger. The narrative surrounding the iPhone in China has been a recurring theme, with varying sentiments influencing stock prices and investor behavior.

Coincidentally, just as concerns were mounting regarding Apple’s market share in China, recent reports indicated a drop in foreign smartphone sales in the region by 44.25% year-over-year. Yet, the Institute for Data Communication (IDC) revealed on January 25, 2024, that Apple’s iPhone had secured the top position in China’s smartphone market, a development that sharply contrasts with prevailing fears about its market share.

Analysts and investors alike await the next earnings report with great anticipation. Apple’s ability to exceed expectations could once again shift the narrative, following a trend where pessimistic views often lead to significant rebounds once solid performance is reported.

“The late-December and early January pump and dump ahead of earnings is in full operation,”

noted MacDailyNews, reflecting the cyclical nature of stock market sentiments surrounding Apple.

In light of recent developments and expert analyses, there is a cautious optimism about Apple’s future, especially in understanding its market dynamics in China. Many investors see potential in the company’s expansion into AI and other technological advancements, suggesting that Apple may turn the tide in the near future if it can effectively navigate current market conditions. As the January 30th earnings report approaches, all eyes will be on Apple to see if it can reinforce its standing, despite the hurdles posed by market dynamics both domestically and internationally.